The CM Punjab Asaan Karobar Card is an innovative program designed to empower small and medium-sized businesses (SMEs) in Punjab. This initiative provides interest-free loans to entrepreneurs, enabling them to expand their operations, improve cash flow, and contribute to economic growth. For 2025, the scheme has introduced structured loan amounts and flexible repayment terms, making it easier for businesses to thrive.

Read More: Asaan Karobar Card Scheme Launched

Table of Contents

CM Punjab Asaan Karobar Card Loan Amounts

The Asaan Karobar Card offers a range of loan amounts to cater to different business needs. The program ensures that both new and existing entrepreneurs can access the necessary funding:

- Minimum Loan Amount: PKR 100,000

- Maximum Loan Amount: PKR 1 million

- Interest Rate: 0% (completely interest-free)

These loans are designed to support essential business activities such as purchasing inventory, paying utility bills, managing supplier payments, and covering operational expenses.p

| Key Details | Description |

|---|---|

| Minimum Loan Amount | PKR 100,000 |

| Maximum Loan Amount | PKR 1 million |

| Repayment Term | 3 years |

| Grace Period | 3 months after card issuance |

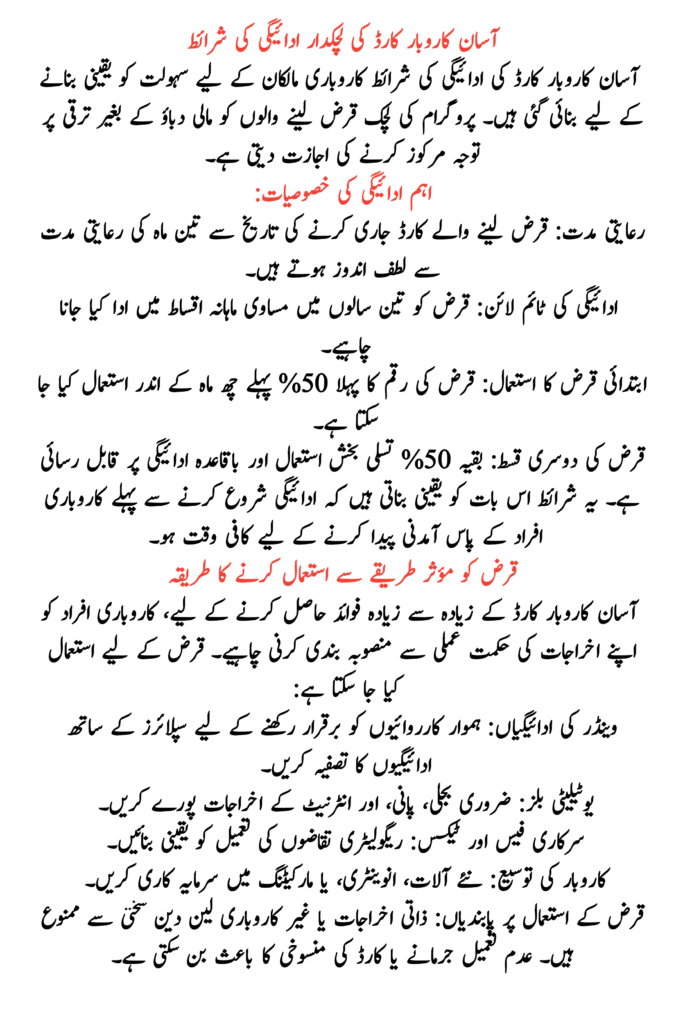

Asaan Karobar Card Flexible Repayment Terms

The repayment terms for the Asaan Karobar Card are designed to ensure convenience for business owners. The flexibility of the program allows borrowers to focus on growth without financial stress.

Key Repayment Features:

- Grace Period: Borrowers enjoy a three-month grace period from the date of card issuance.

- Repayment Timeline: The loan must be repaid in equal monthly installments over three years.

- Initial Loan Usage: The first 50% of the loan amount can be utilized within the first six months.

- Second Loan Installment: The remaining 50% is accessible upon satisfactory usage and regular repayments.

These terms ensure that entrepreneurs have sufficient time to generate revenue before beginning repayments.

Read More: Punjab Asaan Karobar Card Fee Payment

How to Use the Loan Effectively

To maximize the benefits of the Asaan Karobar Card, entrepreneurs should plan their expenditures strategically. The loan can be used for:

- Vendor Payments: Settle payments with suppliers to maintain smooth operations.

- Utility Bills: Cover essential electricity, water, and internet costs.

- Government Fees and Taxes: Ensure compliance with regulatory requirements.

- Business Expansion: Invest in new equipment, inventory, or marketing.

Restrictions on Loan Usage:

- Personal expenses or non-business-related transactions are strictly prohibited.

- Non-compliance may lead to penalties or cancellation of the card.

Eligibility Criteria

To apply for the Asaan Karobar Card, applicants must meet the following requirements:

- Age: 21 to 57 years.

- Residency: Must be a resident of Punjab and hold a valid CNIC.

- Business Location: The business must be located within Punjab.

- Credit History: A clean credit record with no overdue loans is essential.

- Registration: Register with the Punjab Revenue Authority (PRA) or Federal Board of Revenue (FBR) within six months of receiving the card.

By meeting these criteria, applicants can ensure smooth processing of their loan applications.

Read More: Get the CM Punjab Karobar Card

How to Apply for the Asaan Karobar Card

Applying for the Asaan Karobar Card is simple and fully online. Follow these steps:

- Visit the Official Portal: Go to akc.punjab.gov.pk.

- Sign Up: Create an account using your CNIC and a registered mobile number.

- Fill Out the Form: Provide your personal and business details.

- Upload Documents: Attach the required documents, including proof of business and residence.

- Pay the Processing Fee: A non-refundable fee of PKR 500 is required.

- Submit the Application: Double-check your information and submit your form.

Once your application is submitted, you will receive updates via SMS or email about its status.

Advantages of the Asaan Karobar Card

The Asaan Karobar Card offers numerous benefits to small business owners:

- No Financial Burden: Interest-free loans eliminate the stress of high-interest repayments.

- Ease of Access: The online application process is simple and user-friendly.

- Transparency: Digital transactions ensure clear and accountable fund usage.

- Economic Growth: The program supports entrepreneurship, creating jobs and boosting the local economy.

These features make the program a vital tool for small business development in Punjab.

Conclusion

The CM Punjab Asaan Karobar Card is a game-changer for entrepreneurs in Punjab. By offering interest-free loans, flexible repayment terms, and transparent processes, the program empowers businesses to grow and succeed. Entrepreneurs are encouraged to take full advantage of this initiative to achieve their business goals while contributing to the economic development of the region.

For more information or assistance, visit akc.punjab.gov.pk or call the helpline at 1786.

Read More: Interest-Free Loans of 1-30 Million Under Asaan Karobar Scheme

FAQs

1. What is the maximum loan amount under the Asaan Karobar Card?

The maximum loan amount is PKR 1 million.

2. Can I use the loan for personal expenses?

No, the loan is strictly for business-related purposes such as vendor payments, utility bills, and taxes.

3. What happens if I fail to repay the loan on time?

Failure to repay on time may result in penalties or cancellation of the card.

4. How can I check my application status?

You can track your application status online via the official portal or through SMS updates.

5. Are there any hidden charges in the loan program?

No, the program is transparent, with a fixed processing fee of PKR 500 and no interest charges.