If you’re an entrepreneur in Punjab, the Asaan Karobar Finance Phase 2 is your golden ticket to kickstart or expand your business without the burden of interest. Launched on January 15, 2025, this initiative by Chief Minister Maryam Nawaz Sharif aims to empower small and medium enterprises (SMEs) across the province.

Table of Contents

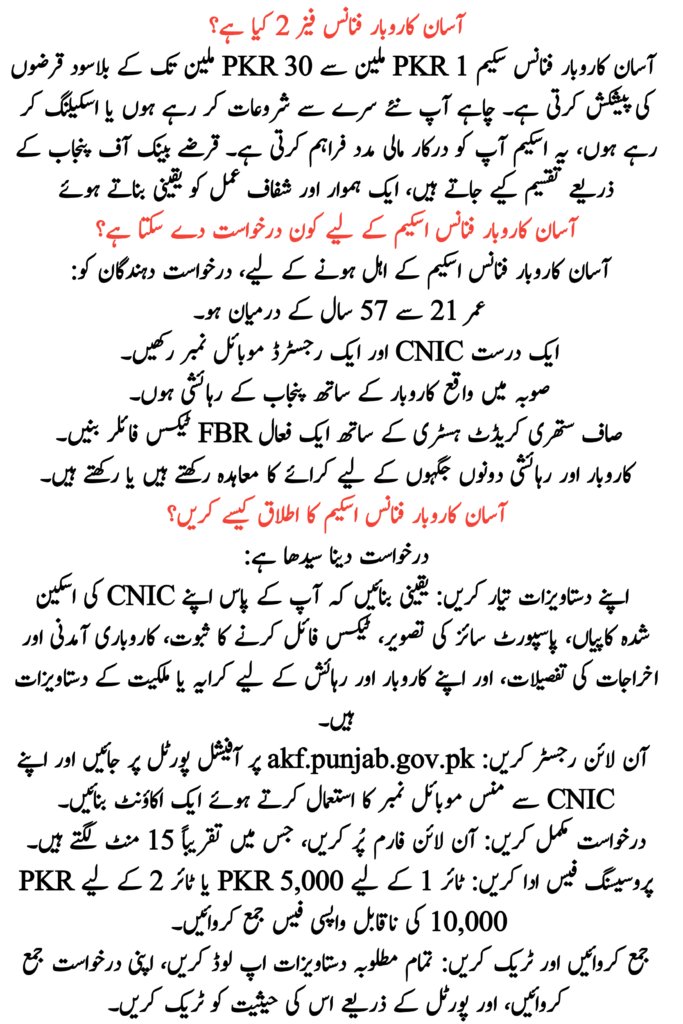

What is Asaan Karobar Finance Phase 2?

The Asaan Karobar Finance Scheme offers interest-free loans ranging from PKR 1 million to PKR 30 million. Whether you’re starting anew or scaling up, this scheme provides the financial support you need. The loans are disbursed through the Bank of Punjab, ensuring a smooth and transparent process.

Read More: BISP New Payments Resume

Key Features Asaan Karobar Finance Phase 2

| Feature | Details |

| Launch Date | January 15, 2025 |

| Application Start Date | January 20, 2025 |

| Loan Amount (Tier 1) | PKR 1 million to PKR 5 million |

| Loan Amount (Tier 2) | PKR 6 million to PKR 30 million |

| Interest Rate | 0% (Interest-free loans) |

| Processing Fee | PKR 5,000 (Tier 1), PKR 10,000 (Tier 2) |

| Repayment Tenure | Up to 5 years |

| Grace Period | 6 months for startups, 3 months for existing businesses |

| Official Website | akf.punjab.gov.pk |

Who Can Apply for Asaan Karobar Finance Scheme?

To be eligible for the Asaan Karobar Finance Scheme, applicants must:

- Be aged between 21 and 57 years.

- Possess a valid CNIC and a registered mobile number.

- Be a resident of Punjab with a business located in the province.

- Be an active FBR tax filer with a clean credit history.

- Own or have a rental agreement for both business and residential premises.

Read More: Benazir Taleemi Wazaif Stipend Increase

How to Apply Asaan Karobar Finance Scheme?

Applying is straightforward:

- Prepare Your Documents: Ensure you have scanned copies of your CNIC, a passport-size photo, proof of tax filing, business income and expense details, and rental or ownership documents for your business and residence.

- Register Online: Visit the official portal at akf.punjab.gov.pk and create an account using your CNIC-linked mobile number.

- Complete the Application: Fill out the online form, which takes about 15 minutes.

- Pay the Processing Fee: Submit the non-refundable fee of PKR 5,000 for Tier 1 or PKR 10,000 for Tier 2.

- Submit and Track: Upload all required documents, submit your application, and track its status through the portal.

Read More: Apply Online for PM Loan Scheme Phase 2

Special Incentives

The scheme offers additional benefits:

- Equity Contribution:

- 0% for Tier 1 loans (except for leased commercial vehicles).

- 25% for leased vehicles.

- 20% for other loans under Tier 1 & Tier 2.

- 10% for females, transgender, and differently-abled persons.

- Additional Support:

- Free solar systems worth up to PKR 5 million for industries in export processing zones.

- Subsidized land for setting up small businesses.

Conclusion

The Asaan Karobar Finance Phase 2 is a transformative initiative, offering interest-free financial support to entrepreneurs in Punjab. By simplifying the application process and providing substantial incentives, the scheme aims to boost economic growth and empower SMEs across the province. Don’t miss this opportunity to take your business to new heights.

Read More: Asaan Karobar Card: Common Application Errors

FAQs

Q1: What is the last date to apply for Asaan Karobar Finance Phase 2?

The last date to submit your application is March 31, 2025. Don’t wait till the last day, because the earlier you apply, the better your chances of early approval.

Q2: Is this loan really interest-free?

Yes, it’s 100% interest-free. The Punjab government covers all the mark-up. You only pay back the principal amount in easy installments.

Q3: Can I apply if I already have a small business running?

Absolutely! Whether you’re just starting or already running a business, you can apply – just make sure your business is based in Punjab.

Q4: Is there any age limit for applying?

Yes, you must be between 21 and 57 years old to qualify.

Q5: Can women apply for this loan?

Yes, and in fact, women, transgender individuals, and differently-abled persons get special relaxation in equity contribution (only 10% required).

Q7: How long will it take for my application to be approved?

Approval time varies, but you can track your application online. Typically, you’ll hear back within 4 to 6 weeks if everything is in order.