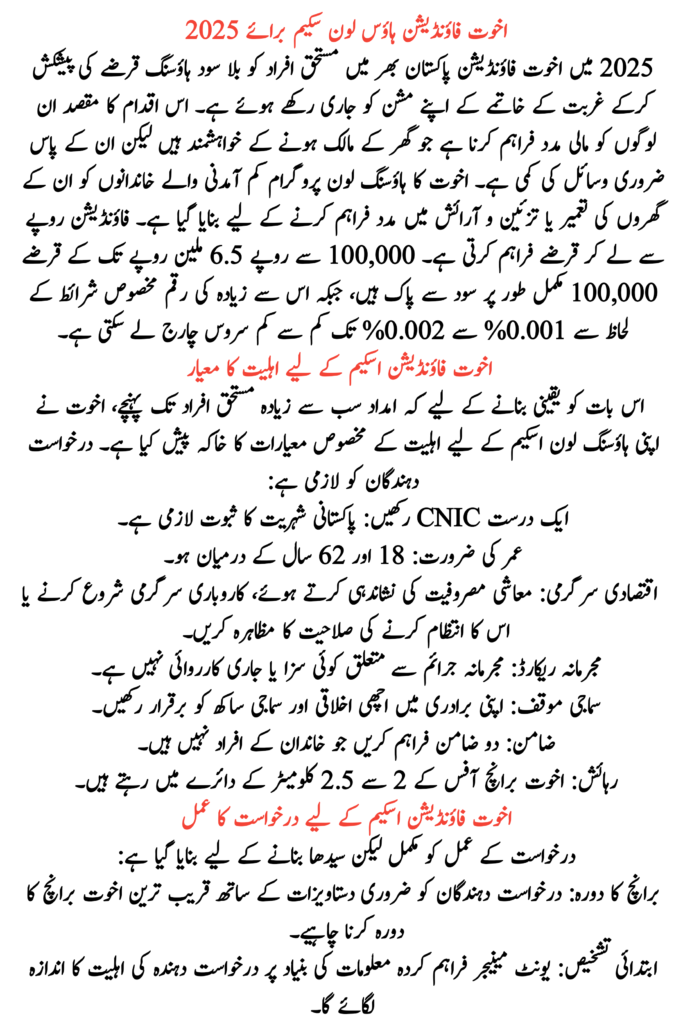

In 2025, the Akhuwat Foundation continues its mission to alleviate poverty by offering interest-free housing loans to deserving individuals across Pakistan. This initiative aims to provide financial assistance to those who aspire to own a home but lack the necessary resources.

Akhuwat’s housing loan program is designed to support low-income families in constructing or renovating their homes. The foundation offers loans ranging from Rs. 100,000 to Rs. 6.5 million. Loans up to Rs. 100,000 are completely interest-free, while amounts exceeding this may incur a minimal service charge of 0.001% to 0.002%, depending on specific terms.

Table of Contents

Eligibility Criteria for the Akhuwat Foundation Scheme

To ensure that the assistance reaches the most deserving individuals, Akhuwat has outlined specific eligibility criteria for its housing loan scheme. Applicants must:

- Possess a valid CNIC: Proof of Pakistani citizenship is mandatory.

- Age Requirement: Be between 18 and 62 years old.

- Economic Activity: Demonstrate the ability to initiate or manage a business activity, indicating economic engagement.

- Criminal Record: Have no convictions or ongoing proceedings related to criminal offenses.

- Social Standing: Maintain a good moral and social reputation within their community.

- Guarantors: Provide two guarantors who are not family members.

- Residency: Reside within a 2 to 2.5 km radius of an Akhuwat branch office.

Read More: Who is Ineligible for the Asaan Karobar Card

Application Process for Akhuwat Foundation House Loan Scheme

The application process is structured to be thorough yet straightforward:

- Branch Visit: Applicants should visit the nearest Akhuwat branch with the necessary documents.

- Initial Assessment: A unit manager will assess the applicant’s eligibility based on the provided information.

- Application Submission: Eligible candidates will fill out a prescribed application form with the assistance of Akhuwat staff.

- Social Appraisal: The unit manager conducts a visit to the applicant’s residence to verify character and credibility.

- Business Appraisal: Evaluation of the applicant’s business plan to ensure its viability and potential for income generation.

- Second Appraisal: The branch manager reviews the initial appraisals and meets with the applicant and their guarantors.

- Loan Approval Committee (LAC): A committee reviews and approves the loan application.

- Disbursement: Upon approval, loans are disbursed, often during events held at community centers like mosques or churches.

Read More: Scholarships for Students from Other Provinces

Eligible Applicant Categories

Akhuwat focuses on assisting specific groups within the community. The six types of individuals eligible for the housing loan scheme are:

- Small Business Owners: Individuals seeking to construct or renovate homes to support their entrepreneurial activities.

- Low-Income Families: Households with limited income aiming to improve their living conditions.

- Widows and Orphans: Providing support to vulnerable members of society in need of housing assistance.

- Disabled Individuals: Persons with disabilities requiring financial aid for accessible housing.

- Disaster-Affected Persons: Individuals whose homes have been damaged due to natural calamities.

- Educators and Health Workers: Low-income teachers and healthcare providers contributing to society but lacking adequate housing.

Required Documentation

Applicants are required to provide the following documents:

- CNIC Copies: For the applicant and guarantors.

- Proof of Residence: Utility bills or rental agreements.

- Income Verification: Salary slips or bank statements.

- Business Plan: Detailed proposal for any business-related activities.

- Photographs: Recent passport-sized photos of the applicant and guarantors.

Read More: Conditions Apply for Asaan Karobar Card Scheme

Loan Repayment

Repayment terms are designed to be manageable, with installments tailored to the applicant’s financial capacity. The foundation emphasizes timely repayments to sustain the revolving fund, enabling assistance to more individuals in need.

Conclusion

The Akhuwat Foundation’s House Loan Scheme for 2025 exemplifies a commitment to social welfare by providing interest-free loans to deserving individuals. By focusing on specific eligible groups and maintaining a transparent application process, Akhuwat continues to empower communities and foster economic development across Pakistan.

FAQs

Who can apply for the Akhuwat housing loan?

Only low-income families, small business owners, widows, orphans, disabled individuals, disaster-affected people, and educators/health workers can apply.

Is the loan completely interest-free?

Yes, loans up to Rs. 100,000 are fully interest-free. Higher amounts may have a minimal service charge.

What documents are needed?

CNIC copies, proof of residence, income verification, business plan (if applicable), and photos.

How do I apply?

Visit the nearest Akhuwat branch, submit the required documents, and go through the verification process.

What is the repayment plan?

Repayment is done in easy monthly installments based on the applicant’s financial situation.

Do I need guarantors?

Yes, two guarantors who are not family members are required.

Where can I get more details?

Visit Akhuwat’s official website or the nearest branch.