If you’re a small business owner in Punjab and applied for the Asaan Karobar Card earlier this year, here’s some exciting news: you can now check your application status online!

Table of Contents

What Is the Asaan Karobar Card?

The Asaan Karobar Card is a government initiative launched in January 2025 to support small and medium-sized enterprises (SMEs) in Punjab. It offers interest-free loans ranging from PKR 100,000 to PKR 1 million, aiming to boost entrepreneurship and economic growth in the region.

Read More: 8171 Web Portal Not Working

How to Check Your Asaan Karobar Card Application Status

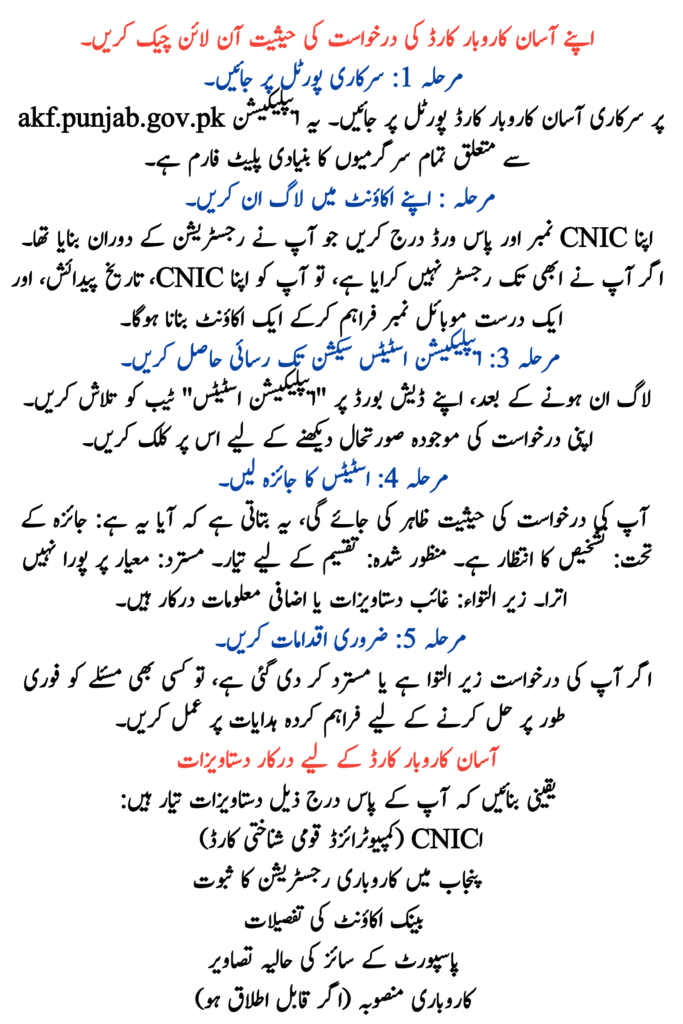

To check the status of your Asaan Karobar Card application:

- Visit the Official Portal: Go to akc.punjab.gov.pk.

- Log In: Use your registered CNIC number and password to access your account.

- View Status: Once logged in, you’ll see the current status of your application, whether it’s under review, approved, or requires additional information.

Asaan Karobar Card Details 2025

| Detail | Information |

| Program Name | Asaan Karobar Card |

| Launch Date | January 16, 2025 |

| Application Deadline | March 31, 2025 |

| Loan Amount | PKR 100,000 to PKR 1,000,000 |

| Interest Rate | 0% |

| Repayment Period | Up to 3 years |

| Grace Period | 3 months |

| Processing Fee | PKR 500 |

| Eligibility Age | 21 to 57 years |

| Application Portal | akc.punjab.gov.pk |

Eligibility Criteria for the Asaan Karobar Card

To qualify for the Asaan Karobar Card:

- Must be a Pakistani national residing in Punjab.

- Age between 21 and 57 years.

- Possess a valid CNIC and a mobile number registered in your name.

- Own or plan to start a business in Punjab.

- Maintain a clean credit history with no overdue loans.

- Pass credit and psychometric assessments.

- Only one application per individual and business is allowed.

Read More: New ATM Facility for BISP

Asan Karobar Loan Usage and Repayment

The funds from the Asaan Karobar Card can be used for:

- Payments to vendors and suppliers.

- Utility bills, government fees, and taxes.

- Cash withdrawals (up to 25% of the limit) for miscellaneous business purposes.

- Digital transactions through POS and mobile app.

Repayment starts after a 3-month grace period, with equal monthly installments over the loan tenure.

Conclusion

The Asaan Karobar Card is a significant step by the Punjab government to empower small entrepreneurs and stimulate economic growth. If you’ve applied, don’t miss the opportunity to check your application status and take the next steps toward expanding your business.

Read More: Asaan Karobar Finance Phase 2

FAQs

How can I check the status of my application?

You can check the status of your Asaan Karobar Card application by visiting the official portal akc.punjab.gov.pk. Log in with your CNIC number and password to view the current status of your application.

What is the eligibility criteria for the Asaan Karobar Card?

To be eligible for the Asaan Karobar Card, you must be a Pakistani national residing in Punjab, aged between 21 and 57 years, and own or plan to start a business in Punjab. You also need a clean credit history and must pass credit and psychometric assessments.

What can I use the loan for?

The loan can be used for various business expenses such as paying vendors, suppliers, utility bills, government fees, taxes, and even cash withdrawals (up to 25% of the loan amount). You can also use the funds for digital transactions via the mobile app or POS.

How long do I have to repay the loan?

The loan comes with a 3-month grace period, after which you must begin repaying in equal monthly installments. The loan tenure is up to 3 years.

Is there any processing fee for the loan?

Yes, there is a processing fee of PKR 500 for the Asaan Karobar Card loan application.

Can I apply for the loan if I have a bad credit history?

No, applicants must have a clean credit history. If you have overdue loans or bad credit, your application may be rejected.

How long will it take to process my application?

The processing time for the Asaan Karobar Card application may vary. However, you can check your application status online for real-time updates on the progress.

Can I apply for this loan if I already have a business loan?

Yes, you can apply for the Asaan Karobar Card if you have an existing business loan, as long as you meet the eligibility criteria and do not have any overdue payments.

Read More: Benazir Kafalat Rs. 13500 Phase 2 Payment