The Asaan Karobar Loan Scheme is an excellent initiative by the government aimed at empowering small entrepreneurs and individuals by providing them with financial support to start or expand their businesses. If you’re wondering how to check your eligibility and apply for this loan, this guide simplifies the process for you.

Table of Contents

The Asaan Karobar Loan Scheme is designed to promote entrepreneurship and create employment opportunities in Pakistan. The scheme provides loans at low-interest rates and easy repayment terms to individuals who meet the eligibility criteria.

Read More: Differences Between Asaan Karobar Card

| Feature | Details |

| Loan Amount | Up to PKR 5 million |

| Interest Rate | 3% to 5% annually |

| Repayment Tenure | 3 to 5 years |

| Eligibility Age | 21 to 60 years |

| Processing Time | 2 to 3 weeks |

| Application Deadline | Ongoing (Check official updates) |

| Launch Date | January 2025 |

| Last Updated | January 21, 2025 |

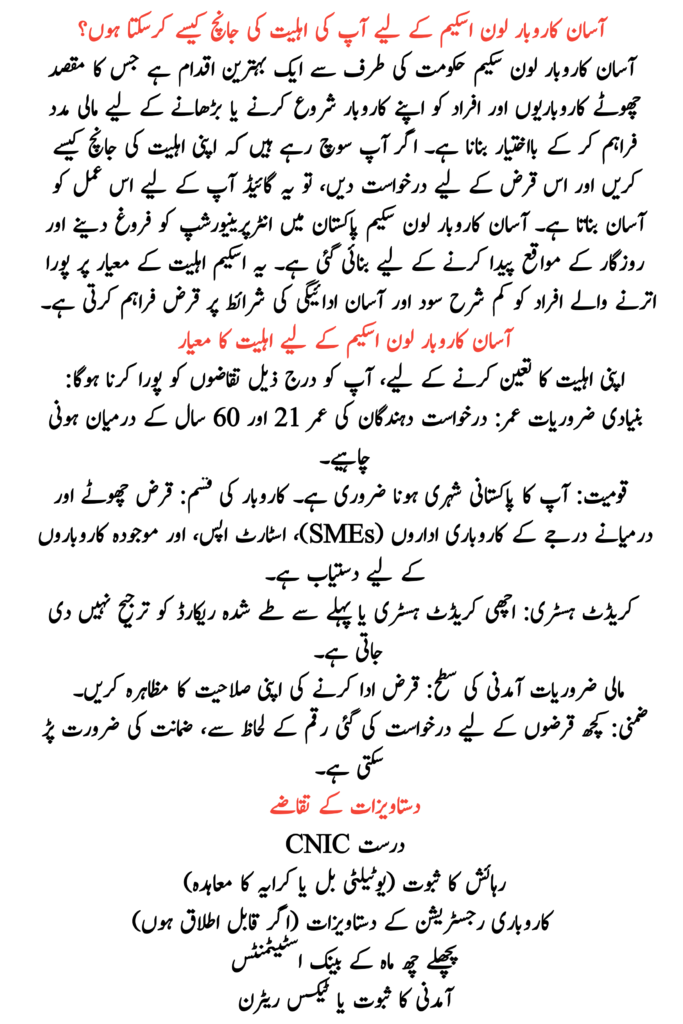

Eligibility Criteria for the Asaan Karobar Loan Scheme

To determine your eligibility, you need to meet the following requirements:

Basic Requirements

- Age: Applicants must be between 21 and 60 years old.

- Nationality: You must be a Pakistani citizen.

- Business Type: The loan is available for small and medium-sized enterprises (SMEs), startups, and existing businesses.

- Credit History: A good credit history or no default record is preferred.

Financial Requirements

- Income Level: Demonstrate your ability to repay the loan.

- Collateral: Some loans may require collateral, depending on the amount applied for.

Documentation Requirements

- Valid CNIC

- Proof of residence (utility bills or rent agreement)

- Business registration documents (if applicable)

- Bank statements for the last six months

- Income proof or tax returns

Read More: Requirements to Apply for Asaan Karobar Finance

How to Check Your Eligibility for the Asaan Karobar Loan Scheme?

Follow these steps to determine if you qualify for the Asaan Karobar Loan Scheme:

Step 1: Visit the Official Website

- Go to the official government website or the designated loan scheme portal.

Step 2: Use the Eligibility Calculator

- Many loan programs provide an eligibility calculator online. Fill in details such as your age, income, and loan requirements to check your status.

Step 3: Visit the Nearest Bank

- You can also visit partner banks offering the loan. Provide them with your documents for an eligibility review.

Step 4: Contact Helpline

- Call the official helpline number provided by the government for detailed guidance.

Read More: Asaan Karobar Finance Scheme Online Apply Rules

Application Process for the Assan Karobar Loan Scheme

Once you confirm your eligibility, follow these steps to apply:

- Collect all required documents.

- Fill out the application form available on the official portal or partner bank websites.

- Submit the form online or visit the nearest branch.

- Wait for the verification and approval process, which may take a few weeks.

Conclusion

The Asaan Karobar Loan Scheme is a golden opportunity for those looking to start or expand their businesses. By ensuring you meet the eligibility criteria and submitting the required documents, you can take a significant step toward financial independence. Check the official website or visit a partner bank to begin your journey today!

Read More: Apply for Asaan Karobar Loan Scheme

FAQs

What is the application deadline for the Asaan Karobar Loan Scheme?

The deadline varies for different phases. Check the official website regularly for updates.

Can women apply for the loan?

Yes, the scheme is open to both men and women entrepreneurs.

Is collateral mandatory?

Collateral requirements depend on the loan amount. Smaller loans may not require collateral.

What documents are required to apply?

CNIC,Proof of income,Business documents (if any),Bank statements

How long does it take to process the loan?

Loan processing usually takes 2 to 3 weeks after application submission.