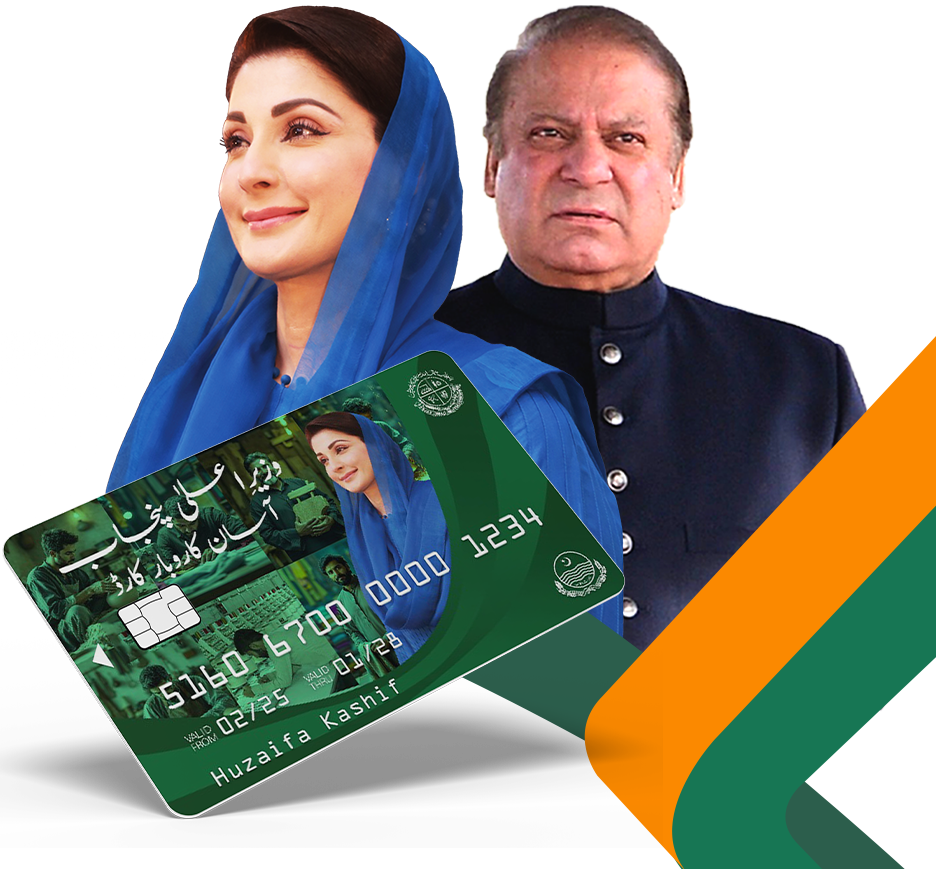

The Asaan Karobar Card is an initiative by the Government of Punjab aimed at supporting small and medium-sized enterprises (SMEs) by providing interest-free loans. This program is designed to foster economic growth by enabling entrepreneurs to start new businesses or expand existing ones.

Table of Contents

| Application Start Date | January 15, 2025 |

| Application Deadline | March 31, 2025 |

| Processing Fee | Tier 1: PKR 5,000Tier 2: PKR 10,000 |

| Eligibility Age | 25 – 55 years |

| Required Documents | CNIC, NTN, Business Premises Proof, Photos, Business Plan |

Key Features of the Asaan Karobar Card: Monthly Installment Plans for Loans

- Loan Amounts:

- Tier 1: Loans ranging from PKR 1 million to PKR 5 million.

- Tier 2: Loans ranging from PKR 6 million to PKR 30 million.

- Interest Rate: 0% for both tiers.

- Loan Tenure: Up to 5 years.

- Grace Period:

- Up to 6 months for startups or new businesses.

- Up to 3 months for existing businesses.

- Repayment: Equal monthly installments over the loan tenure.

- Processing Fee:

- PKR 5,000 for Tier 1 applicants.

- PKR 10,000 for Tier 2 applicants.

- Late Payment Charges: PKR 1 per 1,000 per day on overdue amounts.

Read More: Check Your Asaan Karobar Loan Account Details

Eligibility Criteria for the Asaan Karobar Card

To qualify for the Asaan Karobar Card, applicants must meet the following criteria:

- Age: Between 25 and 55 years.

- Tax Status: Active Federal Board of Revenue (FBR) tax filers with a clean credit history.

- Identification: Valid Computerized National Identity Card (CNIC) and National Tax Number (NTN).

- Business Premises: Ownership or rental agreement of the business location.

Application Process for the Asaan Karobar Card

Interested applicants should follow these steps:

- Online Registration: Visit the official Asaan Karobar Card portal and complete the registration form.

- Document Submission: Upload the required documents, including CNIC, NTN, and proof of business premises.

- Processing Fee Payment: Pay the non-refundable processing fee applicable to the chosen loan tier.

- Verification: Undergo digital verification of CNIC, creditworthiness, and business premises by authorized agencies.

- Approval and Disbursement: Upon successful verification, receive the Asaan Karobar Card loaded with the approved loan amount.

Read More: Check Your Application Status in the Asaan Karobar

Required Documents for the Asaan Karobar Card

Applicants need to provide the following documents:

- Valid CNIC.

- National Tax Number (NTN).

- Proof of business premises (ownership or rental agreement).

- Recent passport-sized photographs.

- Business plan or proposal (if applicable).

Asaan Karobar Card Loan Usage

The funds obtained through the Asaan Karobar Card can be utilized for:

- Payments to vendors and suppliers.

- Payment of utility bills, government fees, and taxes.

- Cash withdrawals (up to 25% of the limit) for miscellaneous business needs.

- Digital transactions via Point of Sale (POS) and mobile applications.

Read More: Application Status in the Asaan Karobar Finance

Asaan Karobar Card Loan Repayment Plan

Repayment begins after the grace period, with equal monthly installments over the agreed tenure. Timely repayments are crucial to maintain a good credit standing and to avoid late payment charges.

Conclusion

The Asaan Karobar Card is a significant initiative by the Government of Punjab to empower small and medium-sized enterprises through interest-free loans. By providing financial support with flexible repayment plans, the program aims to stimulate economic growth and foster entrepreneurship in the region.

Read More: Asaan Karobar Loan Processing Status

FAQs

Who is eligible to apply for the Asaan Karobar Card?

Pakistani nationals aged between 25 and 55 years, who are active FBR tax filers with a clean credit history, and own or rent a business premises, are eligible to apply.

What is the interest rate for loans under this scheme?

The loans are provided at a 0% interest rate, making them highly beneficial for small business owners.

How long is the loan repayment period? The repayment period is up to 5 years, with equal monthly installments.

Is there a grace period before repayment starts?

Yes, there is a grace period of up to 6 months for startups or new businesses, and up to 3 months for existing businesses.

Are there any processing fees?

Yes, the processing fee is PKR 5,000 for Tier 1 applicants and PKR 10,000 for Tier 2 applicants.