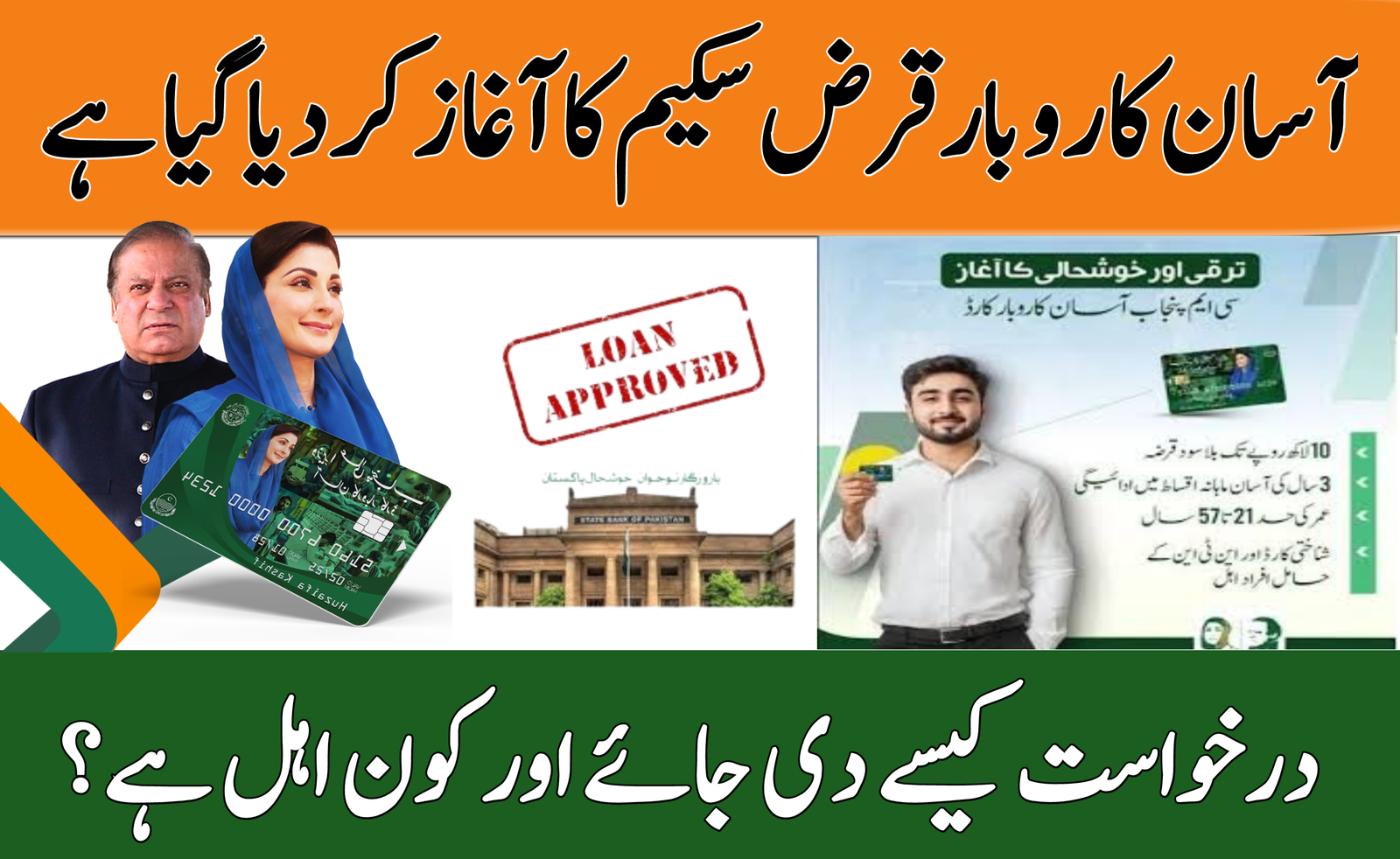

The Asaan Karobar Loan Program is a government initiative designed to provide financial assistance to individuals who want to start or expand their small businesses. This program aims to empower entrepreneurs, reduce unemployment, and promote economic growth in Pakistan.

Table of Contents

The Asaan Karobar Loan Program offers low-interest loans to eligible individuals, ensuring financial accessibility for small businesses. The loan can be used for various purposes, including starting a new business, expanding an existing one, or investing in equipment or inventory.

Read More: Differences Between Asaan Karobar Card

| Feature | Details |

| Loan Amount | PKR 50,000 – PKR 1,000,000 |

| Interest Rate | Low-interest rates |

| Eligibility Age | 18 to 60 years |

| Repayment Tenure | Up to 5 years |

| Application Start Date | January 1, 2025 |

| Application Deadline | March 31, 2025 |

| Required Documents | CNIC, business plan, guarantor details |

| Processing Time | 2-4 weeks after submission |

Asaan Karobar Loan: How to Apply

Step-by-Step Application Process

- Visit the Official Website

Go to the official website of the loan program or the designated financial institution offering the loan. - Create an Account

Register by providing your basic details such as name, CNIC number, and contact information. - Fill Out the Application Form

Complete the application form with accurate information, including your business plan, financial requirements, and repayment capacity. - Upload Required Documents

Attach scanned copies of the required documents (mentioned below). - Submit the Application

After completing the form and attaching the necessary documents, submit the application online or at the designated branch. - Track Your Application

Use the tracking ID provided after submission to monitor the status of your application.

Read More: Requirements to Apply for Asaan Karobar Finance

Eligibility Criteria for the Asaan Karobar Loan Scheme

To qualify for the Asaan Karobar Loan Program, applicants must meet the following criteria:

- Nationality: Must be a Pakistani citizen with a valid CNIC.

- Age: Between 18 and 60 years.

- Business Plan: A feasible and detailed business plan is mandatory.

- Credit History: A clean financial record with no previous defaults.

- Income Level: Priority is given to individuals from low and middle-income backgrounds.

Required Documents for the Asaan Karobar Loan Scheme

Here is a list of documents needed to apply for the loan:

- CNIC copy.

- Two passport-sized photographs.

- Proof of business registration (if applicable).

- Business plan.

- Bank account details.

- Utility bills (as proof of address).

- Guarantor’s CNIC and financial details (if required).

Read More: Asaan Karobar Finance Scheme Online Apply Rules

Asaan Karobar Loan Amount and Repayment Terms

The loan amount ranges from PKR 50,000 to PKR 1,000,000, depending on the nature of the business. The repayment tenure is up to 5 years with a nominal interest rate.

Asaan Karobar Loan Features

- Loan Amount:

- Minimum: PKR 50,000

- Maximum: PKR 5,000,000

- Interest Rate:

- Offers low-interest rates, making it affordable for borrowers.

- Repayment Period:

- Flexible repayment options up to 5 years.

- No Hidden Charges:

- All costs are transparent and communicated upfront.

- Government Guarantee:

- The scheme is backed by the government for added reliability.

Conclusion

The Asaan Karobar Loan Program is a golden opportunity for individuals aiming to start or grow their businesses. By offering low-interest loans and a straightforward application process, the program enables entrepreneurs to achieve their goals and contribute to Pakistan’s economic development. Apply today and take the first step towards a brighter financial future.

Read More: Apply for Asaan Karobar Loan Scheme

FAQs

What is the purpose of the Asaan Karobar Loan Program?

It helps individuals start or expand their businesses by providing low-interest loans.

Can women apply for the loan?

Yes, women entrepreneurs are encouraged to apply for the loan.

Is collateral required?

Collateral requirements vary depending on the loan amount and financial institution.

How can I check the status of my application?

Use the tracking ID provided after submission to check your application status online.

What is the processing time for the loan?

Loan processing typically takes 2-4 weeks after submitting a complete application.