The Ehsaas Naujawan Loan Program is a helpful plan started by the Khyber Pakhtunkhwa government. It gives interest-free and easy loans to young people who want to start or grow a business. The main focus is to reduce unemployment and support entrepreneurship. The loans range from 100,000 to 5,000,000 PKR, and they can be paid back in 3 to 8 years. Young people from the age of 18 to 40 can apply. This program is for everyone, including women, minorities, and people with disabilities. The loan can help people build their future in a better and stable way.

Table of Contents

| Main Feature | Details |

| Loan Amount | PKR 100,000 to PKR 5,000,000 |

| Loan Duration | 3 to 8 years |

| Eligibility Age | 18–40 years |

| Loan Type | Small loans (Akhuwat), Large loans (Bank of Khyber) |

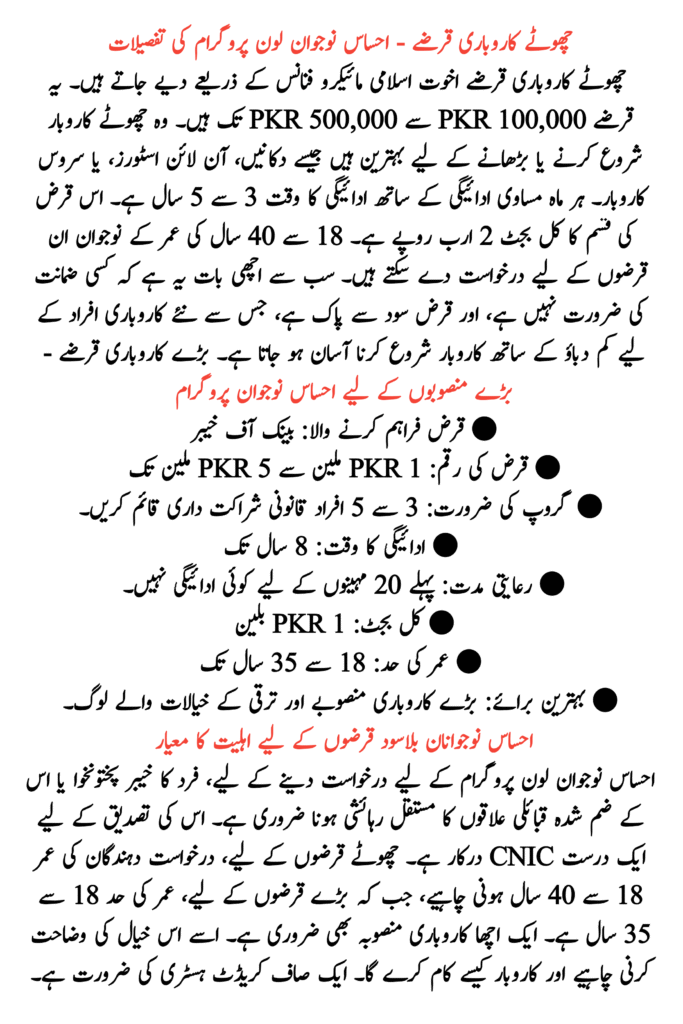

Small Business Loans – Ehsaas Naujawan Loan Program Details

The small business loans are offered through Akhuwat Islamic Microfinance. These loans range from PKR 100,000 to PKR 500,000. They are best for starting or growing small businesses such as shops, online stores, or service businesses. The repayment time is 3 to 5 years with equal payments every month. The total budget for this loan type is PKR 2 billion. Young people aged 18 to 40 can apply for these loans. The best part is that no guarantee is needed, and the loan is interest-free, making it easier for new entrepreneurs to start a business with less stress.

Read More: Punjab Wheat Support Program 2025

Large Business Loans – Ehsaas Naujawan Program for Bigger Plans

● Loan Provider: Bank of Khyber

● Loan Amount: From PKR 1 million to PKR 5 million

● Group Requirement: 3 to 5 people must form a legal partnership

● Repayment Time: Up to 8 years

● Grace Period: No payments for the first 20 months

● Total Budget: PKR 1 billion

● Age Limit: 18 to 35 years old

● Best For: People with big business plans and growth ideas.

Read More: BISP 8171 3rd Phase of Payments

Eligibility Criteria for Ehsaas Naujawan Interest-Free Loans

To apply for the Ehsaas Naujawan Loan Program, the person must be a permanent resident of Khyber Pakhtunkhwa or its merged tribal areas. A valid CNIC is required to confirm this. For small loans, applicants must be 18 to 40 years old, while for large loans, the age range is 18 to 35. A good business plan is also important. It should explain the idea and how the business will work. A clean credit history is needed. Those with business skills or experience will get preference. Some businesses, such as arms or alcohol, are not allowed under this program.

Application Process for Small and Large Loans

For Small Loans (Akhuwat):

● Visit Branch: Go to the nearest Akhuwat office.

● Get Form: Fill out the loan form with your details.

● Submit Documents: Provide CNIC, address proof, and business plan.

● Approval: If approved, you will get the loan in easy steps.

For Large Loans (Bank of Khyber):

● Apply Online: Visit the Ehsaas Naujawan portal or Bank of Khyber branch.

● Upload Documents: Send CNIC, group info, and business plan.

● Bank Review: Bank checks your plan.

● Result in 2–4 Weeks: You’ll get a message if approved or rejected.

Read More: PM Laptop Scheme Apply Last Date

Special Focus on Inclusion in the Ehsaas Naujawan Loan Scheme

This program focuses on giving equal chances to everyone. Female entrepreneurs are especially encouraged to apply. Also, people with disabilities, religious minorities, and madrasa students can apply and are given preference through reserved quotas. This helps make sure that everyone in society, no matter their background, can take part in building their future. The goal is not just to give money but to create a balanced society where more people can work, earn, and support their families. This approach helps bring social change and increases economic strength in all areas of Khyber Pakhtunkhwa.

● Groups of 3–5 people are needed for large loans.

● Only clean credit histories are accepted for application approval.

Conclusion

In this article, we are sharing all the details about the Ehsaas Naujawan Loan Program, which helps young people in Khyber Pakhtunkhwa start or grow businesses. Whether it’s a small shop or a large company, this program supports many dreams by giving interest-free loans. With simple steps, a good business plan, and strong support, this plan is a great chance for youth to move forward. With its focus on fair opportunities and economic development, this program is a powerful tool for building a better future for the region.

Read More: Asaan Karobar Finance Scheme Five Key Verification Points

FAQs

Can I apply for both small and large business loans?

No, you can only apply for one type of loan based on your business plan and age limit.

What happens if my loan application is rejected?

If your loan is rejected, you will be informed of the reason. You may improve your plan and apply again.

Is it necessary to have a business already to apply?

No, you can apply with a new business idea, but you must have a clear and workable plan.

Are there any training programs linked to this loan scheme?

Some branches may offer training or help in preparing a business plan to increase your chances of approval.